Bengaluru’s mid-segment housing struggles as costs climb, supply shrinks

Bengaluru’s booming tech economy has fuelled property demand, but wage growth has not kept pace with soaring home prices and rentals | Photo Credit: Siva SaravananS

Rising inflation and escalating construction costs are putting Bengaluru’s mid-segment housing market, homes priced between ₹45 lakh and ₹1 crore under sustained pressure. Over the past three years, this segment, which typically averages ₹6,000 to ₹9,000 per sq. ft., has seen demand shift and supply shrink, forcing developers to recalibrate toward more premium offerings.

According to exclusive data from ANAROCK, Bengaluru alone recorded approximately 68,790 units sold in the ₹40–80 lakh range between 2022 and H1 2025. But sales have steadily declined: from 28,270 units in 2022, to 19,405 in 2023, then 15,455 in 2024, and just 5,660 units in the first half of 2025.

Construction costs up 40 per cent, affordability squeezed.

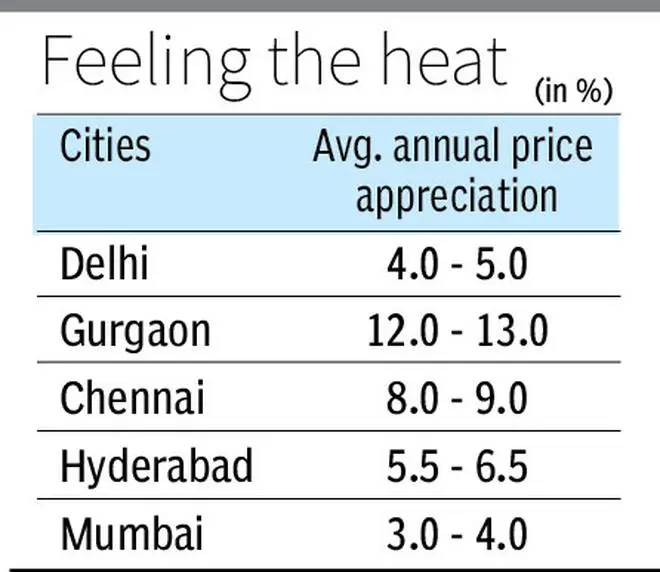

The sales slowdown is closely tied to rising input costs. Construction expenses have surged nearly 40 per cent across India, with cities such as Mumbai, Delhi, and Bengaluru feeling the heat. According to ANAROCK, 5–6 per cent of the increase in input costs is being passed directly to buyers. For affordable and mid-income buyers, even a price hike of ₹500–₹800 per sq. ft. can mean an added burden of ₹5 lakh, a significant stretch for price-sensitive households. “Even a modest hike impacts affordability dramatically,” ANAROCK noted, emphasising the fragility of mid-segment demand.

The shift in demand is reflected in new project launches. According to Prashant Thakur, Executive Director & Head – Research & Advisory at ANAROCK Group, only 6 per cent of new launches in H1 2025 were in the mid-segment category, a stark drop from previous years.

Among Bengaluru’s mid-segment micro-markets, Bagalur led with a 75 per cent jump in average residential prices between 2022 and H1 2025, followed by Devanahalli (50 per cent) and Electronic City (44 per cent).

Housing affordability crisis

Bengaluru’s booming tech economy has fuelled property demand, but wage growth has not kept pace with soaring home prices and rentals. As the income-to-housing cost ratio deteriorates, the city faces a widening housing affordability crisis, especially for IT professionals and the urban middle class, said Samantak Das, Chief Economist and Head of Research & REIS, India, JLL .

The share of mid-segment housing in total new supply fell from 81 per cent in 2022 to just 35 per cent by end-2024. With land prices rising and construction costs climbing, many developers are shifting their focus to higher-margin premium projects, leaving the mid-income population with limited affordable choices.

Some developers, however, are still placing strategic bets on the mid and mid-premium segments. “We’ve consciously focused on the mid-market and mid-premium segments, which we believe offer a longer runway,” said Gopalakrishnan J, ED & CEO, Shriram Properties Ltd. “This shift helps us stay aligned with buyer sentiment, protect margins, and maintain a balanced risk-return profile.”

Shriram has increased its mid-segment launches to over 75 per cent, up from less than 50 per cent between 2022–2024. The company has also managed to keep construction costs stable through early bulk sourcing, design standardisation, value engineering, and use of modern systems such as ALUFORM and precast.

Interestingly, despite market headwinds, Shriram has observed an improvement in average sales velocity across its mid-segment portfolio. Buyer profiles are evolving too. In 2022, most buyers came from households earning ₹18–25 lakh annually; by 2024, this had shifted to the ₹22–30 lakh bracket—signalling growing acceptance of higher ticket sizes.

New players are also entering the segment. Priyanka Raju, Director at Kalyani Developers, said their ₹45–90 lakh homes saw strong absorption, reflecting pent-up demand in this price band.

Meanwhile, Madhusudhan G, Chairman & MD, Sumadhura Group, highlights the role of psychology in the market: “In real estate, FOMO is real,” he said . “When buyers see prices steadily rising, they rush to purchase, worried they won’t be able to afford it in the future,” he added.

Looking ahead, Madhusudhan expects the market to consolidate over the next two to three years, with volumes and prices largely stable, and only mild price increases to match inflation. “We don’t expect dramatic shifts. The market will settle into a more stable rhythm,” he said .

Published on August 21, 2025