Cost Inflation Index for calculation of long term capital gain for FY24 fixed at 348

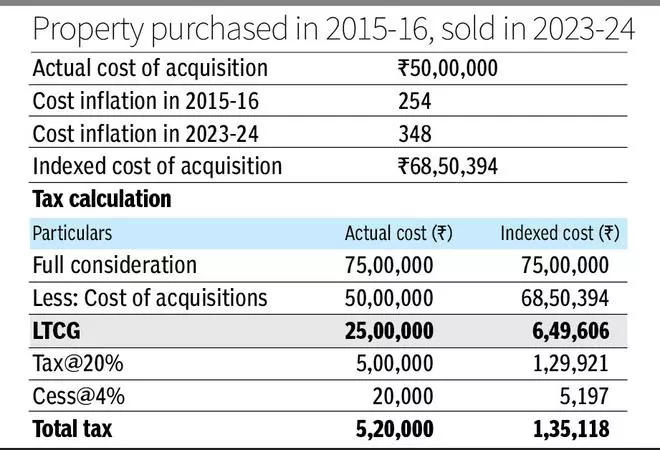

Long-term capital gain liability on the sale or transfer of any capital asset, such as land, property, trademarks, patents, etc., is expected to be lower this year as Cost Inflation Index (CII) for Financial Year 2023-24 has been fixed at 348 as against 331 for Financial Year 2022-23. This shows a rise of 5.14 per cent.

The Central Board of Direct Taxes (CBDT) has notified the index.

“This notification shall come into force with effect from the 1st day of April 2024 and shall, accordingly, apply in relation to the assessment year 2024-25 and subsequent assessment years,” it said.

Calculating inflation

The CII number assists in determining the long-term capital gains on which an assessee is required to pay taxes when she/he files income tax returns (ITR) next year.

CII is a way to calculate inflation, that is, an estimated increase in the price of a good or service over the years. Indexation is used to adjust the purchase price of an investment to reflect the effect of inflation on it.

- Also read: Retail inflation eases to 6.44% in February

With the help of indexation, one will be able to lower her/his long-term capital gains, which brings down taxable income. The rate of inflation to be used for indexation can be obtained from the government’s CII.

The Central government notifies the index. Usually, for the calculation of CII, gains on long-term capital are taken into account.

Benefitting taxpayers

To benefit the taxpayers, the CII is applied to the long-term capital assets, due to which purchase cost increases, resulting in lesser profits and lesser taxes.

The indexation was in news recently as Finance Act 2023 removed this for debt mutual funds.

From April 1 and onwards gain for funds will now be taxed at the investor’s tax slab rates, rather than the previous 20 per cent with indexation benefit and 10 per cent without that as a result, if the investor is subject to the highest tax bracket, this rate would be 35.8 per cent (including surcharge and cess).

Expert’s take

According to Rajat Mohan, Senior Partner with AMRG & Associates, Income Tax Department notified the current fiscal’s cost inflation index to calculate long-term capital gains from the sale of immovable property, securities, jewellery or any other capital assets.

“This year’s cost of inflation index is notified three months earlier by the tax department as compared to last fiscal year. Taxpayers can now precisely and accurately compute tax on long-term gains in the Q1 of FY 2023-24 and pay the necessary advance tax,” he said