In Bengaluru, PG owners plan to hike rent to offset GST burden

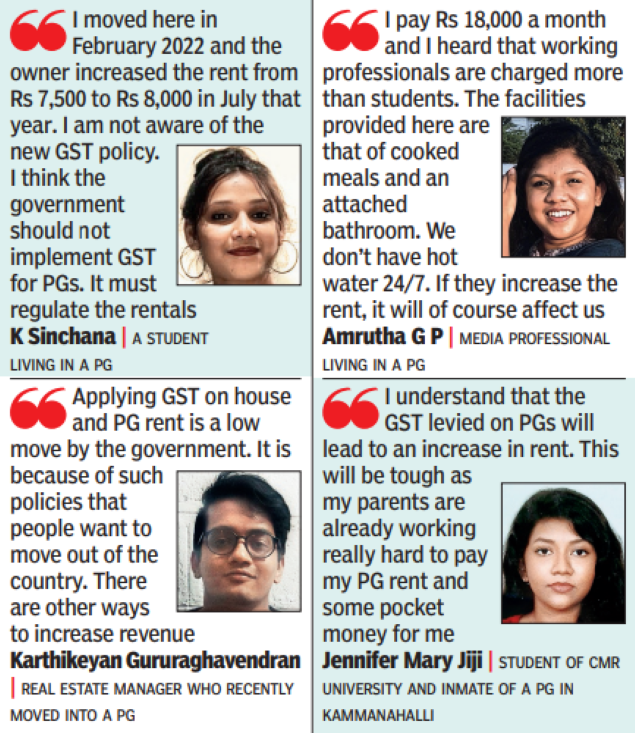

BENGALURU: The recent order of Bengaluru bench of the Authority for Advance Ruling holding that paying guest (PG) accommodations and hostels attract 12% GST as they are not options for permanent residence is likely to push up rentals.

“On average, a PG in the city has 20-30 rooms and the rent paid by the PG owner to the landowner for such a space varies between Rs 2-4 lakh per month. If GST is to be paid by the owners on all PG rents received, then the rents will see a rise anywhere between 10-12%. This will make it living in a PG costlier for the end consumer by Rs 1,000 at least,” said Sampat Althur, president of the Bengaluru PG Owners’ Association.

According to Althur, there may be about 20,000 PGs in the city and over 90% of them are low-cost, small-scale ones run by locals. “Most of the members are small-scale PG owners and a very few in Bengaluru are run as professional and upmarket co-living spaces,” he added. He said his association is considering challenging the GST order in the high court. “There is still ambiguity because the same policy says that if the turnover of the business is less than Rs 20 lakh per annum, then they may be exempt from such a tax,” he added.

Why tax PGs now

The authority’s ruling puts the PG/hostel industry at par with the hospitality industry and hence, makes it liable to pay GST on its earnings. It noted that PGs take residential properties on rent, then build walls and set up beds to rent. It stated that the number of people sharing a room determines how much each individual is charged and acknowledged that there are no dedicated kitchens for each occupant. “These are not features of a permanent stay,” the ruling summarised.

Even the food, washing machine and other services provided in the accommodations are liable for taxation separately as the authority ruled that they cannot be bundled up with the rent amount and will draw 12% GST. Melbin Matthew, CEO of Serenity Hostels, told TOI that they were charging 5% GST on the food provided in the hostel, but had a tough time explaining the reason to the parents. “The parents ask us how they can claim this 5% GST on food in the income tax returns, but you cannot claim for food you eat in a restaurant, right?” he stated.

The policy of treating food as a separate service could be used to segregate the business in one PG under different people to reduce the annual turnover for enjoying exemption, Althur suggested.

“We have 15 hostels across the city with 2,000-2,500 tenants. Once the contract is signed, we cannot increase the rent. After the pandemic, this is another blow to our industry,” Matthew said.