Three lakh people to pay higher property tax in Chennai

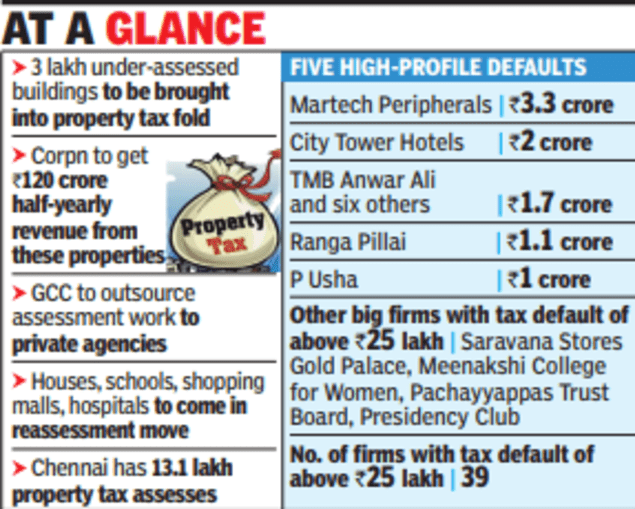

CHENNAI: Three lakh people, including owners of individual houses, educational institutions and commercial properties, will soon be paying a higher property tax in the city. The corporation will bring three lakh under-assessed buildings into the property tax fold.

“We will be outsourcing the assessment work and it will begin soon. This will bring us an additional half-yearly revenue of 120 crore,” said deputy commissioner (revenue and finance) Vishu Mahajan.

Officials said several buildings over the years have done reconstruction or remodelling that have not yet been assessed. This drive with the help of GIS mapping will help to achieve that.

The civic body used to get 30% revenue from property tax before the general revision and it is expected to rise to 50% after the general revision. With the corporation’s outstanding debt still being at several thousand crores of rupees, this additional revenue will help to off-set it.

K Dhanasekaran, the chairman of accounts standing committee of the city corporation, said several educational institutions and business entities like gold showrooms were the big violators. “Some private schools have done extra construction which needs to be mapped. These institutions too are tax-defaulters. The corporation must use private agencies to collect tax from high-profile defaulters,” he said.

He said many other measures like linking Aadhaar with property registration and property tax payments would help. “When a person is registering for a newer building, if his Aadhaar is linked with property tax payments, authorities can find his default status and the no-objection certificate for new registration could be withheld till he pays,” he said.

While the move to outsource revenue collection has worked in some places like Ranchi, according to officials, it is yet to be seen if those could be implemented in the city. “We also have to look if outsourcing tax collection would cause any untoward incidents. Secondly, tax-collection is a sovereign duty of the state and it is another point to look at when it comes to outsourcing,” said the deputy commissioner.

Meanwhile, the corporation on Friday named 39 high-profile property tax defaulters who have arrears of more than ₹25 lakh. Together, they owe the civic body ₹24 crore. Among the defaulters, Martech Peripherals owes the civic body ₹3.3 crore, City Tower Hotel owes ₹2 crore, T M B Anwar Ali owes ₹1.7 crore, Ranga Pillai owes ₹1.1 crore and P Usha owes ₹1 crore.

Pachaiappas Trust Board owes ₹63 lakh, Meenakshi College for Women owes ₹53 lakh, Saravana Stores Gold Palace owes ₹47 lakh and The Presidency Club owes ₹38 lakh.